Why 300% ROI Might Be the Dumbest Goal in Marketing

ROI and CPA are just two sides of the same coin. Chasing the "perfect" number is like trying to win a race by looking at your dashboard instead of the road. Here’s how I scale smarter, profit harder, and ignore vanity metrics that don’t move the bottom line.

ROI and CPA: Same Coin, Different Sides

Everyone loves bragging about ROI.

“We hit 300%!”

Cool. But what does that actually mean?

Here’s the raw truth: ROI doesn’t equal profit. And neither does CPA.

In fact, ROI and CPA are just two sides of the same coin. ROI tells you how much return you get per dollar spent. CPA tells you how much you pay per acquisition. When ROI goes up, CPA goes down—and vice versa.

So obsessing over either is short-sighted. You’re optimizing a ratio, not building a business.

Why ROI Isn’t the Goal

ROI is a mathematical relationship between how much you spend and how much revenue you make. But here’s what it doesn’t tell you:

- How much margin is left after costs.

- Whether you’re maximizing your market opportunity.

- If your ad spend is scalable.

Let’s say you hit 400% ROI spending $10,000. You make $40,000 in revenue. Great, right?

But what if you could hit 150% ROI by spending $100,000 and generate $250,000 in revenue? Even after higher spend, your profit is likely much higher because of volume.

ROI looks better at smaller scale. But profit looks better when you grow.

That’s why ROI is often out of sync with business goals. High ROI usually means you’re underinvesting. You’re leaving opportunity on the table to make the spreadsheet look good.

The Real Goal: Profitability

Profitability takes everything into account. It looks at margins, overhead, CAC, lifetime value, and growth potential. And it’s not always clean or sexy. But it’s real.

Let me say it this way: ROI is a snapshot. Profitability is the movie.

Optimizing for ROI might help your campaign report look awesome this month. But if your CAC stays low because you’re afraid to scale, your competitor will spend more, grow faster, and out-market you.

It’s the difference between appearing efficient and actually building leverage.

<

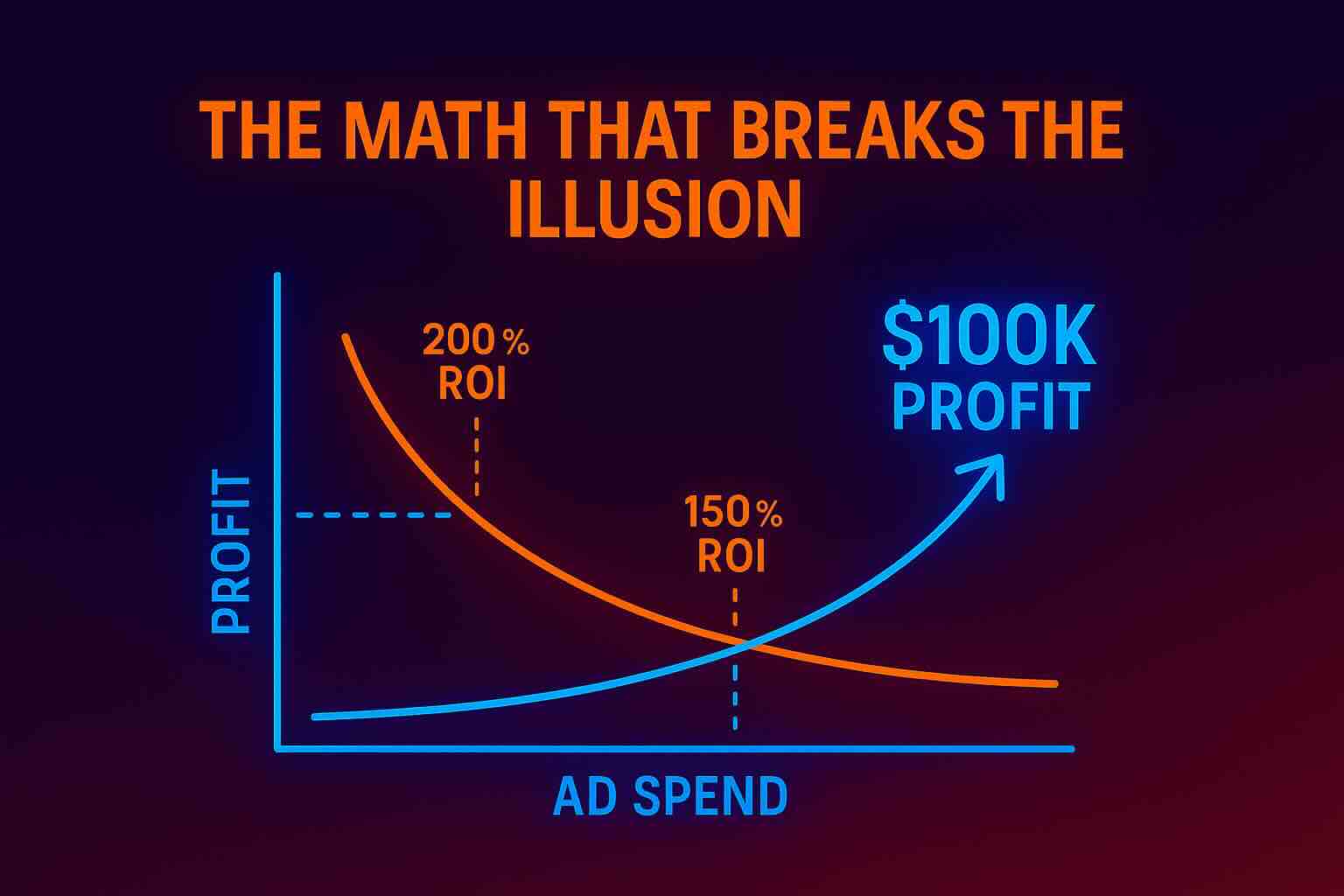

The Math That Breaks the Illusion

You spend $50,000 and get 200% ROI. That’s $100,000 in revenue and $50,000 in profit.

Nice. Looks clean in a spreadsheet.

Now let’s say you scale to $200,000 in ad spend, and ROI drops to 150%. Revenue jumps to $300,000. Profit doubles to $100,000.

The ROI went down. But the business made more money.

Visualizing the trade-off: lower ROI, higher profit with scale

My Campaign Method: Break Even, Then Build

I’m not saying ROI is meaningless. I’m saying it’s a tool, not a goal.

Here’s how I run campaigns:

- Break even first. Get to the point where your spend pays for itself.

- Scale aggressively. Once we’re breaking even, I push hard to scale. Volume turns small margins into serious cash.

- Lower bids gradually. As we grow, I slowly drop bids. That increases ROI and lowers CPA over time.

- Dial in the sweet spot. Eventually, we find the magic middle: profit is maxed without sacrificing too much volume.

That’s how you grow campaigns, not just impress finance.

Forget Vanity Metrics. Optimize for Reality.

Most marketers chase ROI like it’s a trophy. I treat it like a tuning dial.

If you’re clinging to a 300% ROI or a super-low CPA, ask yourself: Would you rather look good in a report or make more money in the real world?

Want a strategy that scales and actually grows your business? See How we Can Help.

PPC Is Not a Gamble, It’s a Data-Driven Money Machine

[anchor id=1] The Myth of Easy ROI Too many businesses expect PPC to be profitable from day one. That’s not…

Reading Time: 3 min

Is Your ROAS Is Lying to You? — Here's How to Read the Truth Before You Burn Good Campaigns

I've seen this movie too many times. You’re running paid media for a startup. Pressure’s on. You need results—fast. So…

Reading Time: 3 min

How to Set Your Startup's PPC Budget Without Guesswork or Regret

Startups love speed. But when it comes to PPC, rushing in without a plan can burn your budget—fast. One of…

Reading Time: 3 min